In the competitive B2B landscape, retaining customers isn't just important—it's essential for profitability. Studies show that acquiring a new customer can cost five to twenty times more than retaining an existing one, and boosting retention by just 5% can increase profits by 25%. At the same time, the European market is highly fluid: a 2024 report found that 44% of European consumers are open to switching their mobile service provider. To address this churn risk and protect revenue, companies are turning to AI-powered churn prediction.

AI has become a strategic lever in this context. About 51% of sales leaders now consider AI a pivotal element of their CRM strategies, and AI-driven predictive analytics in CRM has been credited with reducing churn by around 20%. Likewise, customer-experience research from McKinsey shows that enhancing the customer experience can decrease churn by almost 15% and increase win rates by nearly 40%. These statistics underscore why organisations are adopting AI-powered churn prediction to retain their customers.

Ready to implement AI?

Get a free audit to discover automation opportunities for your business.

Why churn prediction matters

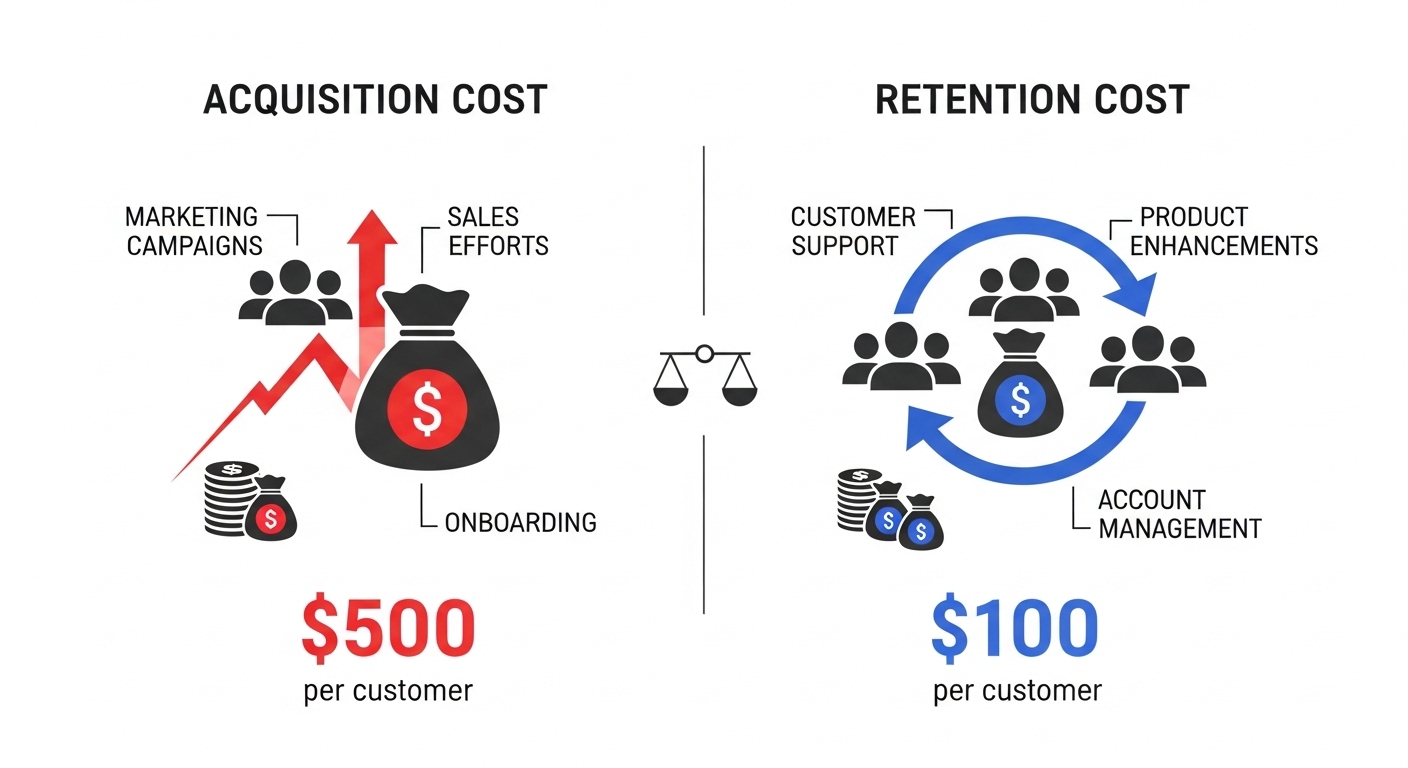

Customer churn refers to customers who discontinue their relationship with a business. It's a costly problem because the cost of winning new accounts far outweighs the cost of retaining existing clients. For fintech, e-commerce, manufacturing and other verticals, churn erodes revenue streams, impacts marketing budgets and damages customer lifetime value. As competition intensifies and customer expectations rise, predicting churn before it happens becomes critical.

Limitations of traditional approaches

Traditional churn prediction methods rely on static data and simple statistical models, such as logistic regression. While these models offer basic insights, they often struggle to adapt to the dynamic behaviour of modern customers. Research notes that older methods using static data may not adjust to rapid changes in customer behaviour, whereas AI-driven models learn continuously and deliver greater accuracy.

How AI enhances churn prediction

Analyzing dynamic behavioural signals

AI-powered churn prediction uses machine learning to detect subtle patterns that indicate when a customer may be at risk. Instead of only looking at when churn occurred in the past, AI models analyse dynamic factors such as support interactions, login frequency and usage patterns. This granular analysis reveals early warning signs that would be missed by static models and enables businesses to intervene before a customer leaves.

Segmentation and lifetime value ranking

Advanced models can rank customers by their likelihood to churn and their expected lifetime value, helping teams prioritise retention efforts. Predictive AI identifies the precise demographics and behaviours of high-risk customers. By segmenting customers based on risk level, businesses can tailor retention strategies and allocate resources where they will have the greatest impact.

Personalised retention strategies

Effective churn reduction depends on personalised outreach. According to research, 71% of consumers expect companies to deliver personalised interactions, and 76% become frustrated when communication isn't personalised. AI-powered churn prediction provides the insights needed to craft targeted campaigns and proactive customer support. When combined with automation tools, companies can deliver timely, relevant communications and offers.

Real-world results: Hydrant case

The power of AI-driven churn prediction isn't theoretical. For example, the home-services platform Hydrant implemented predictive AI to identify likely churners and ran targeted campaigns. The company achieved a 260% higher conversion rate and a 310% increase in revenue per customer. This case demonstrates how AI insights translate into significant revenue uplift when used to inform retention strategies.

Best practices for implementing AI-driven churn prediction

Integrate data sources

Combine data from CRM systems, support logs, product usage and marketing to build a comprehensive view of customer behaviour. Pattern recognition across all touchpoints helps identify early churn signals.

Segment customers by risk level

Use machine-learning models to group customers by their likelihood to churn. Prioritise high-risk segments for proactive outreach and personalised incentives.

Focus on personalisation

Tailor communications and offers based on each segment's unique needs. Hyper-personalised messaging increases engagement and reduces churn.

Monitor in real time

Implement real-time analytics to alert support teams as soon as churn signals appear. Prompt interventions can resolve issues before customers leave.

Choose advanced AI models

Select models that learn and adapt over time to capture changing patterns in customer behaviour.

Test and iterate

Continuously refine models and retention campaigns. Monitor performance metrics such as churn reduction, increased revenue per customer and ROI from retention programmes.

Industry applications for your audience

Fintech and financial services

For banks, insurers and fintech startups, AI churn prediction can detect early signs of dissatisfaction in account holders. Models may look at usage patterns of mobile apps, payment habits and support interactions to flag potential churners. Proactive retention reduces fraud risk, preserves customer lifetime value and improves customer experience.

E-commerce and retail

Online retailers often struggle with high support costs and slow response times. AI churn prediction helps e-commerce players identify customers who exhibit declining engagement or cart abandonment. By segmenting customers and delivering personalised discounts or loyalty rewards, retailers can increase customer loyalty and reduce churn.

Manufacturing and supply chain

Manufacturing companies depend on long-term relationships with distributors and supply-chain partners. AI-driven churn prediction can analyse order frequency, delivery delays and service feedback to anticipate churn. Early alerts allow businesses to adjust production schedules or address logistical issues, preserving partnerships and ensuring smoother supply chains.

Marketing and advertising agencies

Marketing agencies can use AI-powered churn prediction to maintain client portfolios. By monitoring campaign performance metrics and client communication, agencies can identify clients at risk of switching providers and deliver personalised, data-driven proposals to retain them.

Conclusion

AI is revolutionising how businesses predict and prevent customer churn. By leveraging machine learning to analyse dynamic behavioural data, rank customers by risk and lifetime value, and personalise retention strategies, companies can protect revenue and enhance customer loyalty. Evidence suggests that AI-driven predictive analytics in CRM can reduce churn by about 20%, while enhancing customer experience can lower churn by nearly 15% and boost win rates by almost 40%.

The case of Hydrant—achieving a 260% higher conversion rate and 310% revenue increase per customer—illustrates the transformative potential of AI-driven churn prediction. With clear best practices and industry-specific applications, B2B organisations in Europe can harness AI to reduce churn, lower costs and drive sustainable growth.