Artificial‑intelligence assistants are becoming essential helpers for knowledge workers, but the distribution of tools across professions is far from uniform. A recent survey of AI‑assistant products shows that roughly two‑thirds of offerings are aimed at technical users, leaving only a small share for other business roles. This article summarises the current landscape and identifies areas where new products could add significant value.

Ready to implement AI?

Get a free audit to discover automation opportunities for your business.

Where the Market Is Concentrated

Most AI‑assistant products are designed for developers and other technical professionals. The largest categories include AI agent builders, which provide frameworks for creating custom agents (about 140 tools), and coding assistants, which help with tasks such as code generation, debugging and testing (94 tools). Supporting categories like productivity (44 tools), general‑purpose agents (37), digital workers (41), data‑analysis assistants (18), research tools (17) and science tools (11) broaden the range but still cater mainly to programmers, data scientists and researchers. In total, these technical categories represent about 402 of the 601 tools listed on the AI Agents List, or roughly 67 % of the market.

The dominance of developer‑oriented tools reflects two factors. First, programmers were among the earliest adopters of generative AI: code‑generation models such as ChatGPT and GitHub Copilot quickly proved their value by automating repetitive tasks and boosting productivity. Second, building agentic systems often requires technical expertise; frameworks and dev‑tool integrations reduce the barrier for developers to build custom agents, spurring a proliferation of coding‑focused products.

Tools for Other Business Roles

The remaining third of the market targets non‑technical roles. Customer‑service agents (about 40 tools) automate support and handle routine customer interactions; marketing assistants (22 tools) help with campaign planning and content optimisation; sales assistants (23 tools) streamline lead generation and outreach; content‑creation assistants (24 tools) draft text and design marketing materials; and business‑intelligence agents (21 tools) analyse data for strategic insights. Smaller niches include finance (16 tools), personal assistants (10), voice‑AI agents (13), design tools (8) and human‑resources assistants (5). Together these categories highlight a growing interest from lawyers, marketers, operations managers and other knowledge workers, but the count of products remains comparatively modest.

One reason for the slower adoption outside programming is the higher level of context and domain knowledge required. Drafting a contract or building a sales pipeline involves nuanced understanding of legal obligations, industry regulations and interpersonal dynamics; general AI models struggle to provide reliable guidance without significant human oversight. Early products in these domains focus on narrow, well‑defined tasks such as document summarisation or marketing‑copy generation, but more sophisticated, domain‑specific assistants are still emerging.

Untapped Niches and White‑Space Opportunities

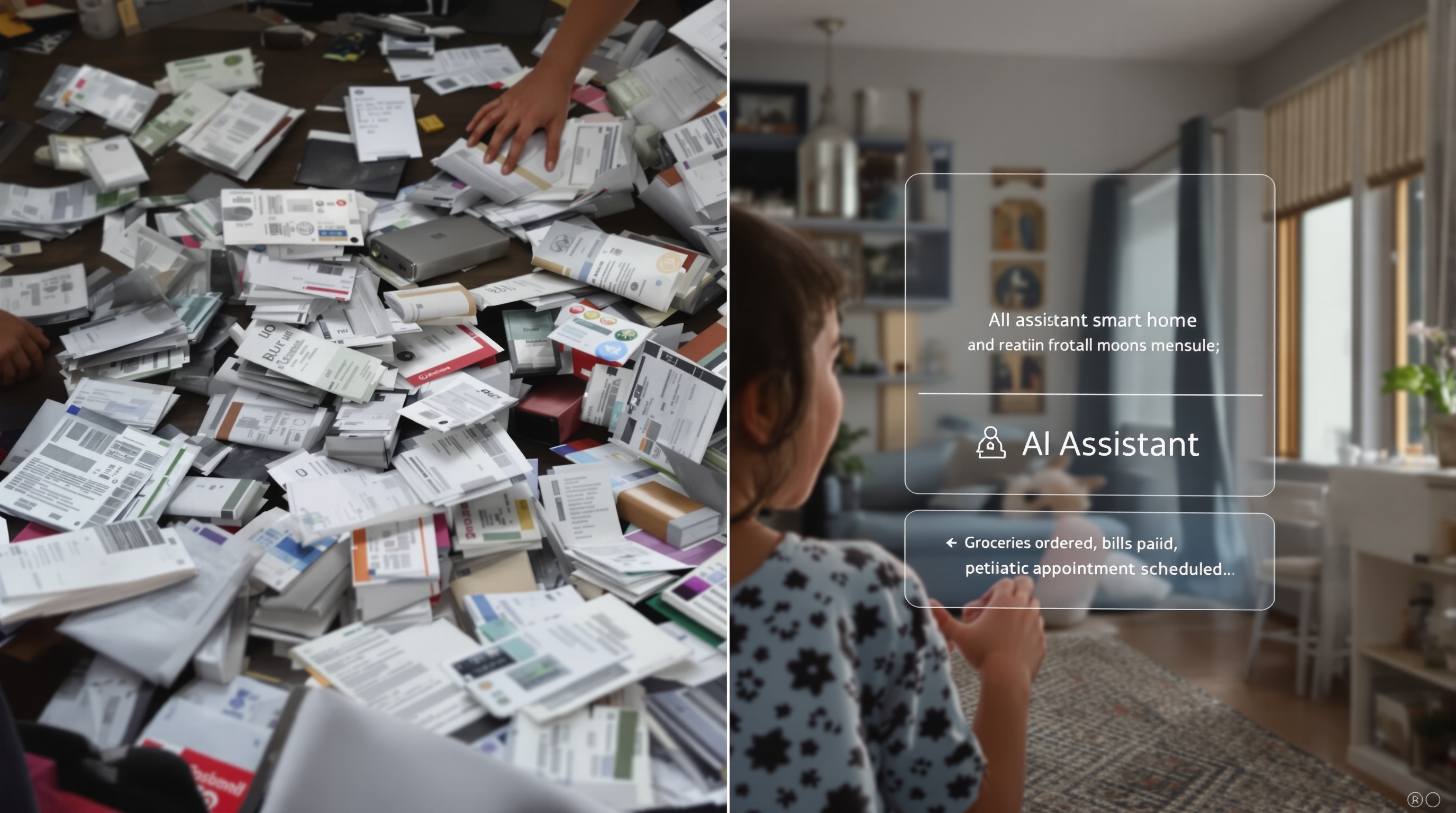

According to Menlo Ventures' State of Consumer AI report, high‑impact personal tasks remain largely underserved because they demand deep context, high trust and reliable execution. These "white‑space" opportunities include:

Healthcare and wellness. While 71 % of people research health questions, only 20 % use AI to do it. There is room for trusted assistants that combine generative AI with vetted medical knowledge and human oversight to deliver personalised advice and triage.

Financial management. 82 % of people pay bills, but only 16 % use AI for help. Tools that organise personal finances, forecast cash flow and automate payments could fill this gap if they can demonstrate security and accuracy.

Social connection and relationship management. 76 % of people connect with friends, yet only 14 % use AI to maintain relationships. AI companions could assist with event planning, remembering milestones and facilitating deeper conversations.

Personalised learning. 77 % of adults engage in learning, but just 18 % use AI. Beyond language apps, there is demand for adaptive coaching platforms that teach complex skills, from maths to music, while providing measurable progress.

Home and family management. 66 % of people handle home repairs, yet only 13 % use AI; similarly, only 34 % of parents use AI for family logistics. Agents that manage contractor vetting, repair scheduling, household budgeting, and parenting coordination could become indispensable as they mature.

These niches share three traits: tasks are frequent, complex and trust‑intensive. As a result, generalist chatbots often fall short, leaving an opening for specialised assistants that blend AI with professional expertise and personalised data. Importantly, many users already combine general‑purpose tools with specialised ones—about 60 % of AI users leverage multiple assistants for different needs—suggesting they are willing to pay for high‑trust solutions that work.

Conclusion

The AI‑assistant market is heavily concentrated in developer tools, with about two‑thirds of products targeting technical users. While this reflects strong early adoption among programmers, it leaves significant white space in high‑value personal and professional domains such as healthcare, finance, education and family management. These areas require specialised assistants that combine AI with deep domain knowledge and earn user trust through accuracy and reliability. As the technology matures and more products address these underserved niches, the next generation of AI assistants will move beyond code generation to become indispensable partners in everyday life.